The president is right on China, but is Wall Street trying to undermine him?

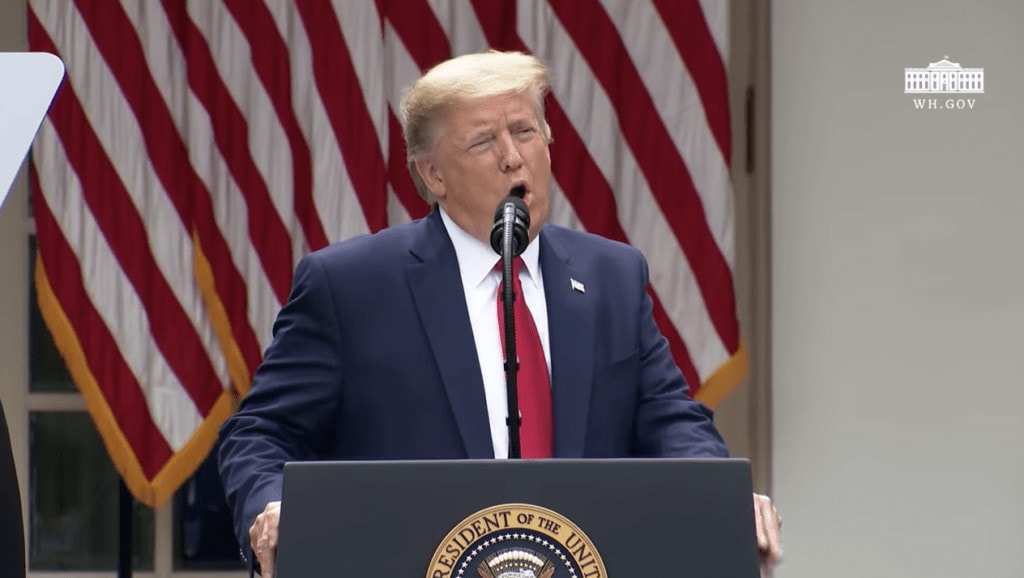

On Friday, President Trump boldly made clear that the United States would no longer be patsy to China. He clearly stated a desire to remove fraudulent Chinese shares from our markets along with Chinese companies that violate human rights, flout our regulations, and threaten our nation’s security.

Originally published by Global Economic Warfare

On Friday, President Trump boldly made clear that the United States would no longer be patsy to China. He clearly stated a desire to remove fraudulent Chinese shares from our markets along with Chinese companies that violate human rights, flout our regulations, and threaten our nation’s security. And yet, as he was speaking, Blackrock was actively using public money to buy Exchange Traded Funds (ETFs) that appear to contain Chinese investments, essentially (albeit stealthily) undermining his stated policy intentions. This must be addressed!

Here’s the Background:

President Trump gave his remarks at a Friday Press Conference, directly endorsed one of the critical things that a few of us have been advocating. In my last blog post, I shared why and how we should deregister and delist potentially fraudulent Chinese shares from our markets.

President Trump echoed those sentiments in his press conference on China:

I am also taking action to protect the integrity of America’s financial system — by far, the best in the world. I am instructing my Presidential Working Group on Financial Markets to study the differing practices of Chinese companies listed on the U.S. financial markets, with the goal of protecting American investors.

Investment firms should not be subjecting their clients to the hidden and undue risks associated with financing Chinese companies that do not play by the same rules. Americans are entitled to fairness and transparency.

Here is the full speech on YouTube:

This was bold leadership and likely went against the advice of every Wall-Street-devotee of his administration. Very few wanted to call out China or address their unfair advantages in our stock market until the President began to pay attention. A small group of us along with some patriotic politicians were both pounding the table and knocking our heads against the wall to get this done. But this President must not be thwarted on this important issue. He had the boldness to stop the Thrift Savings Plan (TSP) from investing billions of dollars of the retirement savings from public servants, retirees, active-duty military, and veterans in Chinese shares (something else we had been advocating). That action now seems obviously right to all but Wall Street sycophants.

Now, however, the President has taken the same logic and wants to put a stop to Chinese companies receiving better treatment than our own companies in our markets. He wants to end the string of frauds pushed on American investors. He wants to stop companies that violate our rules, abuse human rights, or threaten national security from taking American investor dollars. Good!

For too long, Chinese companies have been allowed to get away with failing our audit standards. They refused to allow companies to submit to the same oversight. Sadly, during the Obama/Biden years, we actually signed a Memo of Understanding that gave them permission to flout our rules and safeguards. With the exposure of accounting fraud at Luckin Coffee (that some called the “Starbucks of China”), investors saw $12 billion of shareholder value evaporate. NASDAQ pushed for delisting. It’s bad enough that happened but it is far from the only example.

- Ten Absolute Truths About the 2020 Election and Election Fraud That Every American Should Understand - January 3, 2021

- The president is right on China, but is Wall Street trying to undermine him? - June 1, 2020

- Why we may have to deregister (and delist) Communist Chinese shares from US markets - May 14, 2020